Gone are the days of overflowing paper files and endless phone calls. The modern insurance adjuster is armed with a powerful arsenal of tech tools, transforming claims processing from a laborious chore into a streamlined and efficient workflow. Let’s dive into some of the game-changing tech advancements revolutionizing the claims landscape:

- Mobile Claims Platforms: Say goodbye to bulky laptops and hello to pocket-powered efficiency. Mobile claims platforms allow adjusters to manage everything from initial intake to final reports on their smartphones or tablets. Imagine , documenting witness statements, and even generating initial estimates, all while standing amidst the wreckage.

- AI-powered Claims Processing: Artificial intelligence is no longer science fiction. Advanced algorithms are now analyzing claims data, identifying patterns, and even suggesting potential fraud. This frees up adjusters’ time to focus on complex cases and nuanced investigations, while AI handles the routine tasks with remarkable accuracy.

- Drone Technology: Forget scaling precarious ladders or renting expensive cranes. Drones equipped with high-resolution cameras are providing adjusters with a bird’s-eye view of disaster zones and inaccessible areas. Imagine surveying roof damage after a hail storm without setting foot on the property, or capturing panoramic views of flood-ravaged landscapes with ease.

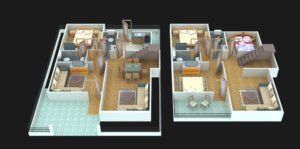

- Virtual Reality (VR) Inspections: Stepping into the future, VR technology is allowing adjusters to virtually immerse themselves in damaged properties. Imagine putting on a VR headset and walking through a fire-ravaged room, examining burn patterns and assessing structural integrity from the comfort of your office. This not only saves time and travel expenses but also enhances safety and accuracy.

- Cloud-based Data Storage: Paperwork nightmares are a thing of the past. Cloud storage platforms provide a secure and centralized repository for all claims documentation, photos, reports, and communication logs. This ensures instant access for adjusters and authorized personnel, regardless of location, and promotes seamless collaboration between teams.

- Real-time Communication Tools: Gone are the days of frustrating phone tag. Instant messaging apps and video conferencing platforms keep adjusters connected with policyholders, contractors, and colleagues in real-time. Imagine resolving queries, negotiating settlements, and even conducting virtual walkthroughs, all within a single, convenient platform.

The Benefits of Embracing Tech:

By embracing these cutting-edge tools, adjusters can reap numerous benefits:

- Increased Efficiency: Streamlined workflows and automated tasks lead to faster claims processing and improved turnaround times.

- Enhanced Accuracy: Data-driven insights and AI-powered analysis minimize errors and ensure consistent, objective claim assessments.

- Improved Customer Satisfaction: Faster resolutions, better communication, and a more transparent claims process lead to happier policyholders.

- Reduced Costs: Paperless workflows, efficient communication, and optimized resource allocation translate to significant cost savings for insurance companies.

The Future of Claims Processing:

The tech revolution in the insurance industry is only just beginning. As technology continues to evolve, we can expect even more innovative tools to emerge, further transforming the way claims are handled. From augmented reality inspections to predictive analytics anticipating potential risks, the future of claims processing promises to be faster, smarter, and more efficient than ever before.

So, modern adjusters, embrace the tech revolution! Equip yourselves with these powerful tools and watch your claims processing soar to new heights of efficiency and accuracy. Remember, in the digital age, it’s not just about surviving the storm, it’s about harnessing the power of technology to navigate it with confidence and skill.